Module 3 International Economics – International Trade

Stop scrolling and get the academic solutions on International Trade – The Balance of Payments and Exchange Rates Assessment. We provide 100% plagiarism-free work with the help of our experienced and highly educated writers. Students who are looking for a Professional Academic Writing Service can contact us at any time.

International Trade Assessment:-

Trade

- Buying and selling goods and services from other countries

- The purchase of goods and services from abroad that leads to an outflow of currency from the COUNTRY – Imports (M)

- The sale of goods and services to buyers from other countries leading to an inflow of currency to the COUNTRY – Exports (X)

The Flow of Currencies:

Specialisation and Trade

Different factor endowments mean some countries can produce goods and services more efficiently than others – specialisation is therefore possible:

Absolute Advantage:

- Where one country can produce goods with fewer resources than another

Comparative Advantage:

- Where one country can produce goods at a lower opportunity cost – it sacrifices less resources in production

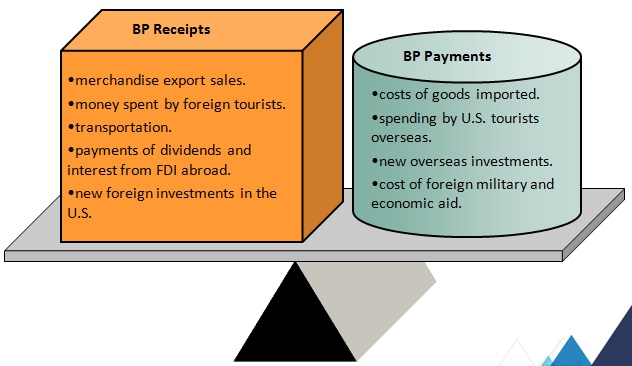

Balance of Payments

- When countries trade there are financial transactions among businesses or consumers of different nations

- Money constantly flows into and out of a country

- The system of accounts that records a nation’s international financial transactions is called its balance of payments (BP)

- It records all financial transactions between a country’s firms, and residents, and the rest of the world usually over a year

- The BP is maintained on a double-entry bookkeeping system

The BP is the difference between receipts and payments

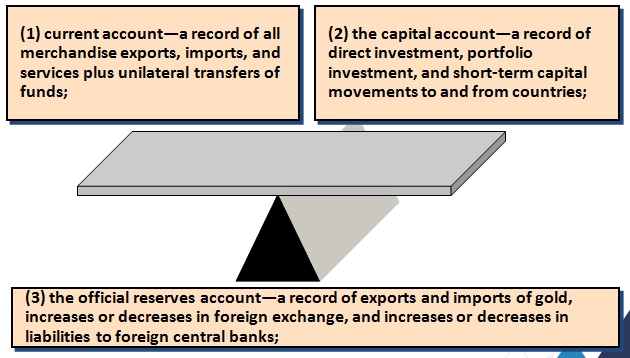

The BP includes three accounts:

Balance of Payments and Exchange Rate

- If a country’s expenditures consistently exceed its income, its standard of living falls

- Its exchange rate vis-à-vis foreign monies declines

- When foreign currencies can be traded for more dollars, U.S. products are less expensive for foreign customers and exports increase

- Simultaneously foreign products are more expensive for U.S. buyers and the demand for imported goods is reduced

Balance of Trade

- Difference in value between its Exports and Imports

- Export is the sale of goods and services to foreign markets

- Import is the purchase of goods and services from foreign sources

- Difference in value between its Exports and Imports

Favorable Balance of Trade :

- When Exports are more than Imports

Negative Balance of Trade or Trade Deficit :

- When Imports are more than Exports

Trade deficits may contribute to

- failure of business ,

- loss of jobs ,

- lower standard of living and other economic and social problems

Exchange Rates

Floating Exchange Rates:

- Price determined only by demand and supply of the currency – no government intervention – India

Fixed Exchange Rates:

- The value of a currency fixed in relation to an anchor currency – not allowed to fluctuate – UAE

Dirty Floating or Managed Exchange Rate:

- Rate influenced by government via central bank around a preferred rate – China

Foreign Exchange Markets

Foreign exchange: all forms of internationally-traded monies including currency, bank deposits, checks, and electronic transfers.

Foreign exchange market: the global marketplace for buying and selling national currencies

Exchange rates fluctuate constantly. E.g., yen-dollar

exchange rate:

- 1985 – 240 yen to the U.S. dollar.

- 2017 – 114 yen to the dollar (nearly 40% appreciation).

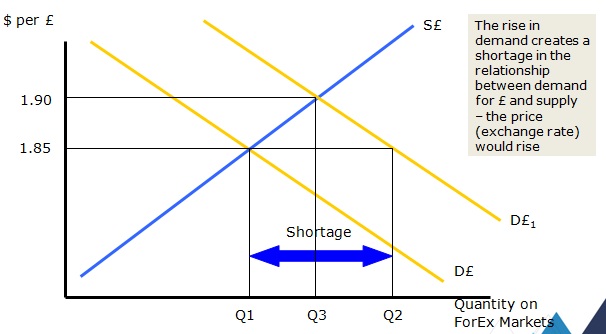

How Exchange Rates are Determined

In a free market, the “price” of any currency (rate of exchange) is determined by supply and demand:

- The greater the supply of a currency, the lower its price

- The lower the supply of a currency, the higher its price

- The greater the demand for a currency, the higher its price

- The lower the demand for a currency, the lower its price

Appreciation and Depreciation: Example

Euro appreciation: If the euro-dollar exchange rate goes from one euro = $1.25 to one euro = $1.50, the euro becomes expensive to Americans

Euro depreciation: If the euro-dollar exchange rate goes from one euro = $1.25 to one euro = $1.00, the euro then becomes cheaper to Americas

Foreign Exchange Rate

Ratio of the currency of one nation to the currency of another nation

When the value of the currency depreciates

- exports are profitable and imports cost more

- China keeps its currency intentionally depreciated as it Exports more than it imports !!!

When the value of the currency appreciates

- exports become less profitable and imports cost less

- Decrease in Japanese exports to U.S.; Increase in U.S. exports to Japan

Example – Currency Depreciation- good for exports

Suppose $1= 114 Yen Which means Yen is a weaker currency. Now when Japan exports , it will receive 114 yen x for 1 $. Suppose the currency depreciated further;

Now $1 = 120 yen

So now it will receive 120 yen for 1$ which is profitable

Example – Currency Appreciation – good for imports

Suppose $1= 100 Yen which means the currency has appreciated Now when Japan imports , it will spend only 100 yen for 1 $. Suppose the currency appreciated further;

Now $1 = 95 yen

So now Japan will spend 95 yen for 1$ when importing which is profitable.

Exchange Rates

Determinants of Exchange Rates:

- Exchange rates are determined by the demand for and the supply of currencies on the foreign exchange market

The demand and supply of currencies is in turn determined by:

- Relative interest rates

- The demand for imports (D£)

- The demand for exports (S£)

- Investment opportunities

- Speculative sentiments

- Global trading patterns

- Changes in relative inflation rates

Exchange Rates