Module 2 Globalization – What Is Global Economy?

Are you stuck with your International Economics Module 2 Assessment – Globalization? At the Australian Assignment Help Website, you will get the Best Assignment Writing Service on your assignments. Our team is available 24 hours to provide you Homework Help on over 100+ subjects. Take our help in getting excellent grades on your assignment work.

What Is Global Economy

- Global Economy

The global economy is all the economies of individual nations that are linked together rather than individual economies. - Globalization

Globalization involves the process of increased integration between countries and economies and increased impact of international aspects of life and economic activity.

Defining Globalization:

A continuous process leading to free movements and transfers of goods and services and factors of production https://www.youtube.com/watch?v=JJ0nFD19eT8

The Characteristics of Today’s Globalization Process

- New and growing social networks overcoming traditional economic, political, cultural, and geographic boundaries

- Expansion of social relations, activities, and interdependence

- Intensification and acceleration of social exchanges

- Globalization of human consciousness; people becoming conscious of global interdependence

The phenomenon

A multi-dimensional phenomenon:

- Economic dimension

- Political dimension

- Social dimension

- Cultural dimension

- Information and knowledge dimension

- The role of media

The Discontents with Globalization

- Widening gap between the poor and the rich.

- Insufficient concern in dealing with environmental consequences of globalization.

- Directed more by politics than by economics.

- The unfair (excessive) influence of the powerful interest groups, particularly the ones in the West

- The conflicts (and competition) between small local businesses and large multinationals often have led to the disappearance of the former.

- The economic system (American style capitalism) forced upon developing countries is not appropriate for many of them and has in fact harmed large segments of their population

- The international organizations (IMF, WTO, etc.) officials mostly from rich countries

- The globalization process is being run in very undemocratic ways. Developing countries have little or no say in the policy making process

- Globalization and free trade have benefited mostly developed countries, widening the gap between the poor and the rich

- Still protective trade policies in developed countries continues, hurting some poor developing countries

- In pursuing their national interests, countries have often sacrificed free trade/free market principles

The Potentials of Globalization

- Free trade will lead to more efficient use of economic resources and thus making the global output pie grow bigger

- Everyone’s share of the pie including the poor gets bigger/ reducing poverty

- Economic interdependence among nations lessens international tensions and conflicts

- As economies grow and international communication improves populations become more alike, allowing for more cooperation among nations in protecting natural resources and environment

UNCERTAINITY OVER BREXIT : ANALYSIS

Rising Brexit uncertainty has reduced investment and employment

- The majority of businesses in the UK report that Brexit is a source of uncertainty.

- This study uses survey responses from around 3,000 businesses to evaluate the level and impact of this uncertainty.

- It finds that Brexit uncertainty has already reduced growth in investment by 6 percentage points and employment by 1.5 percentage points, and is likely to reduce future UK productivity by half of a percentage point.

- Responses from the latest survey of around 3,000 businesses in the UK, using the Bank of England’s Decision Maker Panel (Bank of England 2018),1 give us four key findings about the level and impact of Brexit uncertainty.

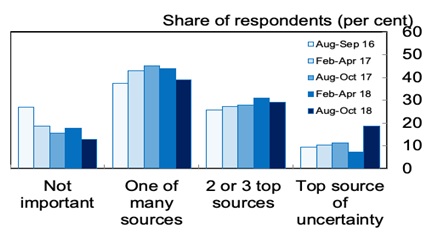

- Brexit is a major and growing source of uncertainty for firms

- In August 2016, in response to the question, ‘How much has the result of the EU-referendum impacted the level of uncertainty affecting your business?’, more than one-third of CEOs and CFOs cited Brexit as at least one of the top three current sources of uncertainty. At the time, 10% said that Brexit was the most important factor and 25% said it was one of the top two or three sources of uncertainty (Figure 1).

Successive waves of this question have shown that firms continue to place Brexit high on the list of sources of uncertainty. The share of firms responding that Brexit was one of the top drivers of uncertainty rose from 35% in August 2016 to almost 40% in August-October 2017, while the share of companies considering Brexit not important in the same period fell from 27% to 16%.

The proportion of firms reporting uncertainty has remained high and has increased further – Brexit uncertainty has not been resolved. By August-October of this year, around the time of the Salzburg summit, around half of firms were reporting Brexit as a top-three source of uncertainty.

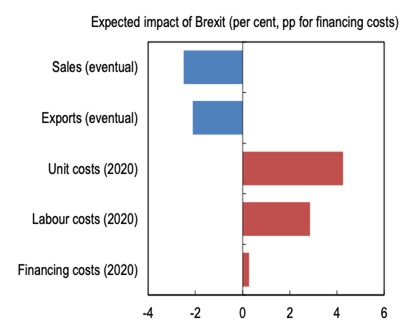

Firms expect lower sales and exports and higher costs

- Figure 2 shows the effects that companies expect Brexit to have on their sales, exports and costs.

- Companies place more weight on Brexit reducing sales than on it increasing them.

- On average, businesses expected Brexit to eventually reduce their sales by around 2.5% (Figure 2).

- There was also a net negative expected effect on exports, while unit costs, labour costs and financing costs were expected to increase.

Brexit has reduced investment and employment growth

- To estimate the impact of Brexit uncertainty, we analysed the change in investment and employment for firms exposed to lower and higher levels of uncertainty.

- This difference-in-difference approach quantifies the effect that Brexit uncertainty has had on growth of investment and employment by firms.

- Our results show the uncertainty is associated with around 6 percentage points less investment.

- This reduction in investment appears to have happened mainly in the first year after the referendum, between July 2016 and June 2017. We also found that that there is 1.5 percentage points lower employment for these firms, with the effect being larger in the second year after Brexit (July 2017 and June 2018) than in the first.

Brexit has lowered UK productivity growth

- Firms in the UK economy that export more to the EU, import more materials from the EU, and employ more labour from the EU were most uncertain and expected Brexit to eventually have a more adverse effect on their sales.

- They are also the firms that have the highest levels of productivity.

We see from Figure 3 that more productive firms expect the eventual effect of Brexit on sales to be more negative (compared to the expected effect of less productive firms).

By a batting average effect, if Brexit reduces the sales of high-productivity firms by more than low-productivity firms that is likely to bring down average UK productivity.

Our estimates suggest this implies about a 0.5 percentage point reduction in future productivity. - Given that the UK economy has had very low productivity growth in the last decade (about 1% in the last few years), this effect is worth around half a year of productivity growth.

Policy Implications

- The UK Parliament’s rejection of the negotiated withdrawal agreement raises the risk of a UK departure from the EU with ‘no deal’ – an extremely costly prospect for UK firms that could lose tariff free access to their largest export market.

- At the same time, our analysis of the UK’s trade in 2016 also highlights an important and vital role played by the WTO for promoting global trade – WTO obligations limit the amount of trade policy uncertainty that countries could face if their existing trade agreements are rescinded.

- Even if Britain’s departure from the EU is disorderly, the highest possible tariffs that UK exporters would face in the EU are defined by the EU’s WTO commitments. These commitments cap the level of tariffs and, thus, limit the uncertainty UK exporters face.