FN222 Agricultural Finance and Risk Management Assignments

Get FN222 Agricultural Finance and Risk Management Assignment Questions and Answers for Australia’s students to score A+ grade in a college Finace accounting assignment help, guaranteed satisfaction. We have 100+ professional assignment writers who are subject matter experts. If you want FN222 Agricultural Finance and Risk Management Assignment Help so connect with Assignmenthelpaus.com and place your order now!

Assignment Details:

- Words: 2000

PART A

Multiple Choice Questions

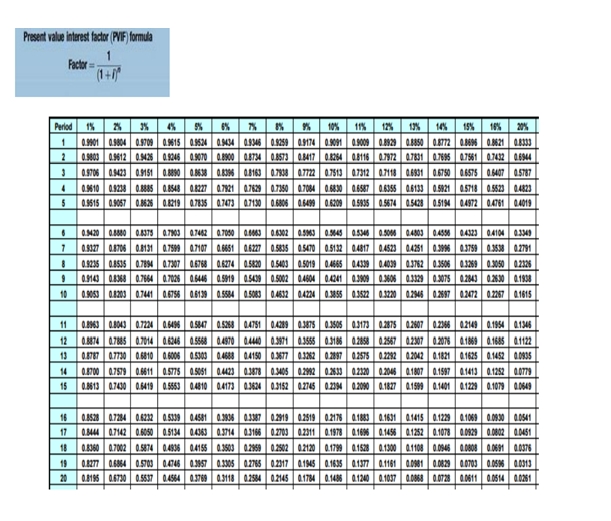

1. If you will be receiving the sum of $100 next year what is its present value today if interest rate is 5%?

A. $95.24

B. $190.48

C. $104.00

D. $210.00

2. Which of the followings is a limitation of financial statement analysis?

A. It is based on historical data and entities may not be comparable.

B. Year-end data are always typical of the entity’s position during the year.

C. The existence of one-off, or non-recurring, items in a statement of profit or loss and other comprehensive income, e.g. losses through floods, cannot inhibit the determination of trends to assess business efficiency.

D. None of the above

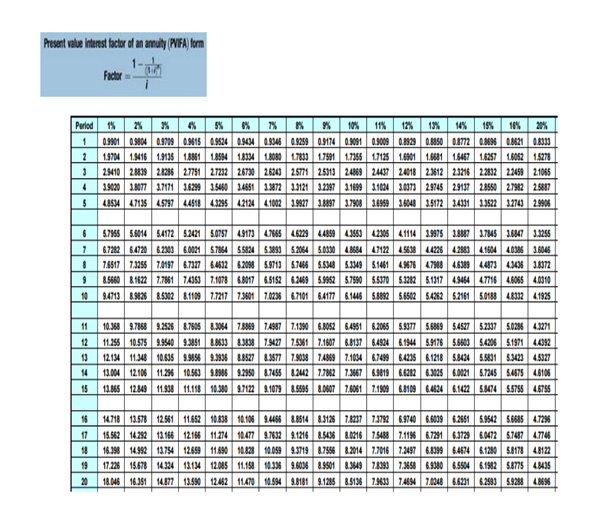

3. A lease of refrigerators will cost Global Fishers the sum of $5,000 every year for five years. At the end of the five-year lease, the freezers could be bought for $20,000. The lease liability is worth $37,317.50. Calculate the implicit rate for the lease.

A. 5%

B. 6%

C. 4%

D. 7%

4. Which of the followings is NOT true about annuities?

A. The ordinary annuity starts payment in period 1.

B. Deferred annuities start payment after year 1.

C. A perpetuity pays only to the next generation of the holder

D. Annuity due starts paying immediately.

5. Calculate the return and risk of a 2-stock portfolio with 70% invested in BHP and the remainder in CBA. BHP has a return of 10% with a standard deviation of 0.08 and CBA has a return of 8% with a standard deviation of 0.16. The covariance between the two stocks is -0.0051.

A. The return is -9.40% and the risk is 0.33%

B. The return is 5.74% and the risk is 9.40%

C. The return is undefined, and the risk is too infinity

D. The return is 9.40% and the risk is 5.74%

6. You will be given the sum of $30,000 in five years from now. What is the present value of the money if interest rate is 5%?

A. $25,000.00

B. $20,000.00

C. $23,505.78

D. $17,007.55

7. You purchased a perpetuity that pays $20,000 per annum. However, the first payment from the perpetuity will occur in four years from now. How much is the perpetuity worth today if interest rate is 2%?

A. $1,500,000.00

B. $1,000,000.00

C. $1,385,768.14

D. $942,322.33

8. Fiat money is not different from commodity money

A. False.

B. True.

C. It depends

D. Since bitcoin is out now we should not be talking about fiat and commodity money

9. A negative NPV project is unacceptable as it would not generate sufficient cash flow to repay the financial cost of undertaking it.

A. True

B. False

C. Not always

D. It depends on the project manager

10. You have expectations that that your investment of $100, 000 into an ice block making machine will earn $30,000 in year 1, $40,000 in year 2, $50, 000 in year 3. You hope to dispose the machine at the end of the third year for $20, 000 and there is no additional working capital for the project. Is the investment worth it if the appropriate cost of capital is 6.5%?

A. The investment is worth it because it will return $121,384.82 which is higher than $100,000. So, the NPV is $21,384.82

B. The investment is worth it because it will return $120,000 which is higher than $100,000. So, the NPV is $20,000.

C. The investment is worth it because it will return $104,827.84 which is higher than $100,000. So, the NPV is $4,827.84

D. The investment is worth it because the there is no additional working capital.

11. DentoClean paid a dividend of $2 today. The shares of DentoClean are expected to grow at 2% with a required return of 4%. What is the price of DentoClean?

A. $100.00

B. $101.00

C. $102.00

D. $67.33

12. A major similarity between futures and forwards is that:

A. Futures are always delivered in the future, but forwards are delivered on the spot

B. Futures are always futuristic, but forwards are forwarded to the stock exchange

C. Futures and forwards are used to hedge houses against robbery

D. Futures and forwards are financial tools used to hedge asset prices against undesirable movements

13. A farm owner puts a sign at the gate of the farm to inform passers-by that they should not enter the farm to pluck his fruits. A man entered the farm but claimed he did not pluck any fruit. Which of the statement below is true about the case?

A. Hieroglyphics should have been used to write the sign so this cannot be an offence

B. The man trespassed and may face the consequences.

C. The man has the legal right to enter the farm since he did not steal anything

D. This is a case of third line forcing and is a form of tort

14. A farm retail store has an Operating Cycle of 47 days and a DPO of 77 days. Calculate the Cash Conversion Cycle (CCC).

A. The CCC is -30 days, the store receives cash about one month before paying its suppliers so is in a good position

B. The CCC is 30 days, the store receives cash about one month before paying its suppliers, so is in a bad position

C. The CCC is -29 days, the store needs to finance its operations for about one month between the time it pays for its raw materials (cash outflow) and the time it collects cash (cash inflow) for the sales of its products.

D. The CCC is 124 days, the store needs to finance its operations for about four months between the time it pays for its raw materials (cash outflow) and the time it collects cash (cash inflow) for the sales of its products.

15. Which of the following is NOT true about Efficient Market Hypothesis?

A. The weak form is based on past prices, the semi-strong form based on publicly available information and the strong form based on all available information.

B. It is a theory that can be used to explain the behaviour of the stock market during a pandemic only

C. It has three forms: Strong, semi-strong and weak

D. The theory suggests that it is impossible to make excess returns in the capital market consistently since new information is compounded into the prices of shares

16. The Big Mac Index is:

A. An index for how hungry a person is when they get to a restaurant.

B. The Big Mac Index is a theory of Purchasing Power Parity within a nation’s domestic market using the prices of KFC, Hungry Jack and Mac Donald to forecast inflation.

C. A comparative measure of prices among eateries like Hungry Jack, McDonald and KFC

D. A measure of Purchasing Power Parity between nations using the price of a McDonald’s Big Mac as a benchmark.

17. Which of the following options best represents Capture Theory of regulatory economics:

A. The regulated industries may wield so much influence over their regulators. Consequently, they will act to control the regulators or ensure non-compliance

B. The captured industry will always act in public interest even when they have been captured.

C. The regulators may be afraid of re-election as in the case of government and so act in public interest.

D. Capture theory means that anyone could be captured to do things in public interest.

18. A bank accepts a company’s 90-day bill with a face value of $2m for an acceptance fee of 100 bps and sells it at 3.00%. Calculate the acceptance fee.

A. $3,324.21

B. $4,847.48

C. $3,311.83

D. $8,814.14

19. An option could be defined as:

A. A form of derivative with an obligation to buy and sell an asset no matter what

B. A form of derivative whereby you have the right to buy or sell an asset without an obligation to do so.

C. A form of derivative with the hope that an asset value will rise and not fall

D. An obligatory note of exchange on an asset that derives its worth from another asset which must be purchased

20. You were presented with some stocks with different correlations but same returns as in the table below. You were allowed to pick a two-stock portfolio. Which pair of stock is the worst pick?

| A | B | C | D | E | |

| A | 1 | 0.98 | 0.72 | 0.21 | 0.45 |

| B | 1 | -0.01 | 0.43 | -0.31 | |

| C | 1 | 0.02 | 0.07 | ||

| D | 1 | -0.17 | |||

| E | 1 |

A. I will not pick stocks A and B because they have the highest correlation and so it will be the riskiest portfolio.

B. I will not pick stocks B and C because they have the lowest correlation and will maximise portfolio risk.

C. I will not pick stocks B and E because they have the lowest correlation and will therefore minimise portfolio risk.

D. I will not pick stocks C and D because they have the lowest correlation and will therefore minimise portfolio risk.

PART B

Long Answer Questions

Question 1:

a. The following are Crystal’s financial data for the three years. Using horizontal analysis, graph the trend in the data (3 marks). Comment on the trend (2 marks). What are your recommendations for Crystal (3 marks)? (8 marks).

| Years | 2016 | 2017 | 2018 |

| Income | $800,000 | $900,000 | $1,020,000 |

| Gross profit | $200,000 | $180,000 | $250,000 |

| Expenses | $50,000 | $80,000 | $300,000 |

b. Use the coefficient of variation to make a choice of stock from the table below:

| A | B | |

| Standard deviation | 19.54% | 23.37% |

| Expected return | 5% | 6% |

Calculate the coefficient of variation for the two stocks

Which stock will you choose?

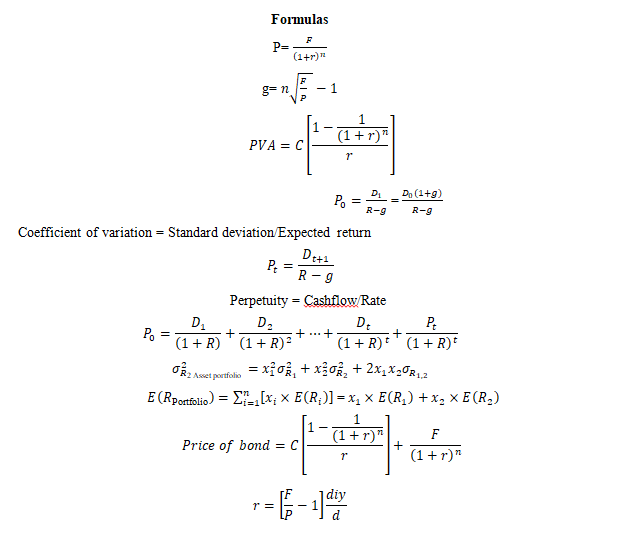

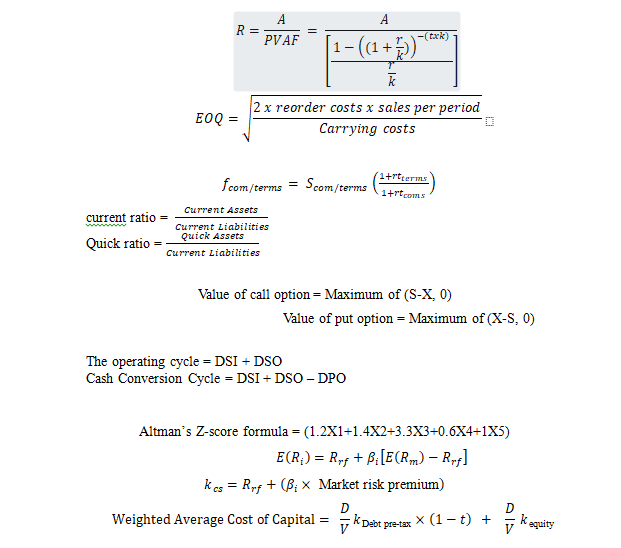

c. Calculate the repayment amount on a loan of $500,000 on a ten-year loan at 12.00% p.a. compounding monthly.

Question 2:

a. Calculate the Altman’s Z value for the following farms.

b. Which of the two farms will you invest into and why?

c. What are the limitations of the Altman’s Z statistics?

(Hint: The formula for the calculation of Z score is in the table, the higher score implies lower risk of bankruptcy)

| Variables | Crystal Farms | Lavish farm |

| X1(net working capital /total asset) | 0.5463 | 0.1354 |

| X2(retained earnings/total asset) | 0.5236 | 0.0124 |

| X3(EBIT/total assets) | 0.1524 | 0.2013 |

| X4(market value of equity/book value of total liability) | 3.5632 | 0.2435 |

| X5(sales/total asset) | 0.9905 | 0.4032 |

| Z-score (1.2X1+1.4X2+3.3X3+0.6X4+1X5)

|

Question 3:

a) Explain the concept of incentive as it relates to moral hazard and adverse selection in the context of agricultural insurance

b) Explain the principal agency problem as it relates to farm ownership?

c) Explain the difference between a technical analyst and a fundamental analyst when it comes to share trading.

d) What is the difference between a crime and tort in the context of agriculture?

For REF… Use: #getanswers2002234