Financial Statement Ratio Case Study Help

Do you need Quality Financial Statement Ratio Case Study Questions and Answers Help at a cost-effective rate? Assignmenthelpaus.com provides you with the Best Assignment Writing Help in Australia by professional writers. Students can avail of our Financial Statement Assignments of all academic levels. Hurry up, place your order get Financial Statement Ratio Case Study Help with the best quality work.

Please answer these question:

1. Evaluate EPC’s Financial Statement using 5 ratio analysis with explanation.

2. Discuss the performance of the company for the three years financial statement as provided in the case

PLANNING FOR CHANGE IN A COMPANY RIDDLED WITH PROBLEMS

by

Kee Sek Cheiw, William G. Borges and Ahmed Razman Abdul Latiff

PROLOGUE

Chen Wha, 57, is the sole proprietor of Easy Power Electrical Central (EPC) in Sungai Petani, Kedah. On 7 February 2012, one week before Chinese New Year, he decided to give bonuses to his employees. After arriving at work one hour early that day, he went through the bank account records and was shocked to learn that the account balance (–RM 338,000) was very close to his overdraft limit of RM 350,000. At same time, he noticed that some utility bills and bank installments were not yet paid. Chen then said to himself, “Oh no! How can this happen? If I don’t pay bonuses, many employees will surely leave the company. Oh God. Please help me, I can’t let EPC collapse.”

COMPANY HISTORY

Easy Power Electrical (EPC) was established as a partnership in 1975 by Chen Wha, his father Kwang and his brother, Seng. EPC was the first electrical shop providing professional wiring, light installation, and trouble shooting for manufacturing plants and residential houses in Sungai Petani, Kedah. EPC also handled purchases of electrical items, such as generator motors, pump motors, lighting and fans.

They had only minor competition from 1975 until 1988, and during this period enjoyed good profits. Consequently, they expanded their business and employed ten electrical supervisors, sixteen electrical technicians and one clerk, and also hired Chen Wah’s sister-in-law as a manager in 1988.

Problems appeared after Chen Wha’s father passed away in 1990. Many electrical supervisors and electrical technicians left the company and formed their own sole proprietorship, directly competing with EPC. The situation became worse when supervisors and technicians managed to attract some of EPC’s customers by offering a cheaper service charge.

Chen Wha and his brother, Seng, continued running the business, but they faced a very serious economic crisis, as did all Malaysian businesses. During the period 1997-1999 the company ran into significant financial trouble. Many of the company’s debtors faced insolvency, which resulted in a huge increase in debt and a huge decrease in revenue. However, EPC enjoyed profitability by 2000, and this continued until 2008 and 2009, when the company once again relied on overdrafts, as they had from 1997-1999.

In February 2009, Chen Wha’s brother decided to quit the business, and Chen Wha used a bank overdraft of RM250,000 to buy him out. Afterward, Seng formed a sole proprietorship, Easy Power Excellent Electrical, and brought with him the main customers of EPC. It is important to note that once his brother left EPC, that company became a sole proprietorship fully owned by Chen Wha and, as a result, Chen Wha had unlimited personal liability and faced gigantic business risks. Indeed, his entire financial future was in jeopardy.

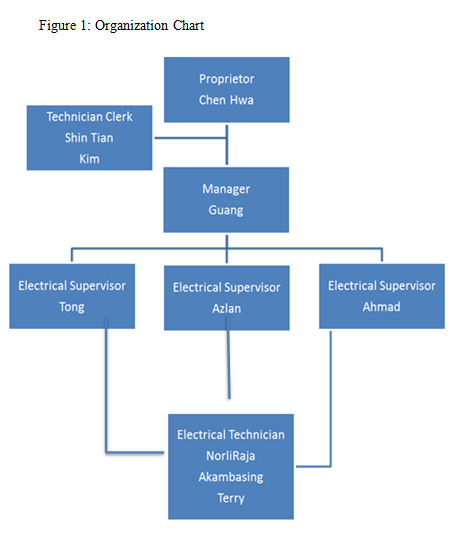

EPC’s business consisted of a professional wiring service, installation of electrical and electronic parts, repairs and maintenance of motors, a unit to deal with Tenaga National Berhad (TNB), retail electronic and electrical items, and troubleshooting electrical problems. To handle all of this Chen Wha employed two local workers and his elder son, Tong, as electrical supervisors; three foreign electrical technicians; one general worker; his daughter, Kim, as clerk; and his son, Guang, as manager. The Organization Chart of EPC of February 2012 is shown in Figure 1.

COMPANY LOCATION

Sungai Petani is a town in the state of Kedah, in the northern part of Peninsular Malaysia. Sungai Petani is the largest town in Kedah, followed by the state capital, Alor Setar.

Since the 1990s the housing sector has been booming in Sungai Petani. The town has received large investments from real estate developers. Sungai Petani has many high-, medium- and small-sized businesses. Together these companies produce numerous products, from semiconductors and television tubes to textiles and wood products.

THE PROPRIETOR’S BACKGROUND

Chen Wha’s education did not extend beyond secondary school. And his knowledge of financial matters was very limited. He lost approximately RM 100,000 (nearly his entire savings) in 1997 because, after receiving a tip from a friend, from his bought shares of a company without analyzing the company’s fundamental. The company on which he gambled eventually fell into PN-17 and was de-listed.

According to Chen Wha’s clerk, Shin Tian, Chen Wha owned a current account under his name, and saved in that account (even though it did not yield any interest), even while EPC had credit in OD. Furthermore, Chen Wha did not understand how to calculate the profitability of transactions after the deduction of material costs, labor costs and bank interest, and he had no idea how or why interest rates changed.

MANAGEMENT AND DAILY OPERATIONS

Guang, Chen Wha’s son, was named manager at age nineteen, one year after completing his SPM exams. He had no prior working experience, and possessed only limited fluency in English and Malay. However, he proved to be a very hard worker, and he displayed fine social skills.

On 17 March 2009, one month after Chen Wha took over EPC, Guang approached him with a very serious question: “Dad, after paying RM250,000 to my uncle, we are almost out of funds. How are we going to survive, since we need to pay cash for raw materials and can collect only after jobs are completed?”. Guang also inquired about the mechanics of pricing (e.g., how to identify whether a given price is enough to cover costs). He learned from his father that it is often possible to collect early payments by giving customers discounts.

Chen Wha explained how this worked in the past: “Normally (technician clerk) Shin Tian will summarize the cost of materials and I will charge an extra 30- 80% on it. Charges for installation and troubleshooting are based on job difficulty and the time it takes to complete. If a customer complains about the price I offer, I will give a 5-10% discount on the total amount. Even when we give customers 5-10% discounts we still earn some profit, because the offered price is still higher than the cost of materials. And if we are able to give a customer a discount, we could end up retaining a customer. We also might give a customer another 2-3% discount, if the customer is willing to pay cash. The objective is to encourage customers to pay cash. Otherwise they must pay within sixty days of the signed Job Delivery (JD).”

Then Chen Wha explained further: “After we get the job, we will assign manpower to it. If something else is needed to continue the work, they either go to EPC directly or go to the supplier. After the job is completed, they will go back to EPC and report what they have done, and everything will be recorded by the clerk in the signed JD. They need to send the JD to get the customer’s signature, after which the payment will be made.”

Chen Wha then discussed rate variations among customers: “There are different charges for different customers. We charge only 5% more than the total of materials and contract-worker wages for new housing-development projects. A standard rate is given to manufacturing plants and regular customers. A higher rate or a flat rate is charged to walk-in customers, because a majority of these customers will ask for some electrical installation. When quoting prices, it is a must to refer to the historical prices first. Charges should not be much different compared to those given historically.”

Guang then asked: “Where should we find the customers?” Chen Wha’s answer was this: “So far we have not done any promotions in any channel; we are the first electrical shop in Sungai Petani, and we are well-known. If we are able to provide good job-quality and competitive prices, customers will look for us in the future. However, you must try your best to find new customers, since we have already lost some of our existing customers, and some of our other customers are looking to our competitors.”

Guang then asked: “Then how many customers, or how much in sales, do I need in order for the company to survive? What are our average sales in a month?” Chen Wha replied that “Well, you don’t need to care about the minimum sales needed to break even; just try your best to find new customers. We don’t not have any targets or budgets, either monthly or yearly. You may, however, ask Shin Tian, if you want to know more about monthly sales.”

WHERE DOES THE MONEY GO?

Shin Tian and Kim are the clerks who assist Chen Wha in managing the company’s accounting. Shin Tian has more than ten years’ experience in accounting for enterprise, and four years’ working experience with EPC. However, Chen Wha’s daughter, who is seventeen and just finished her SPM, is only able to record accounting data and do simple documentation.

Shin Tian and Kim key into the UBS accounting system all accounting data and process the data for accounts receivable, customers’ monthly statements, financial reports, and other accounting reports. But because EPC workers lack sufficient accounting knowledge, the annual financial report is outsourced to an accounting firm, in order to minimize the company’s tax liability.

On 26 April 2012, Shin Tian and Kim were doing the monthly closing, and printing customers’ monthly statements. They were also preparing Chen Wha’s income tax declaration. During all of this Kim asked, “Shin Tian, why do we need to install this UBS accounting system, which costs RM12,000, instead of recording manually by using Microsoft Excel?” Shin Tian replied: “Although installation of UBS is costly, it is the most popular accounting software in Malaysia, and is famous for its easy-to-use features and great flexibility. Furthermore, it comes with UBS Assets Register, which is a handy tool for managing the fixed assets and calculating depreciation. It helps a lot in generating reports for our income tax agent and with monthly closings.”

Kim then inquired, “What will we do with the report generated by using UBS and why we still need to appoint the income tax agent to declare my dad’s income tax, since we are able to prepare financial reports?” Shin Tian offered the following response: “Normally, generated monthly reports are kept on file. We appointed an income tax agent because neither Chen Wha nor I are familiar with income tax regulations and I’m not strong in accounting. My highest education is SPM level, and I am unable to do the analyses on financial reports.”

Kim then asked, “Shin Tian, why, when we made a profit in March 2012, is EPC’s OD still increasing? And why does the account show my father’s personal account as a EPC current asset?” Shin Tian laughed and replied, “This is a sensitive question. “Did you notice the cash withdrawals amounting to RM5500 on 21 March? Actually, it was withdrawn by your father due to his high commitments. Furthermore, he used an EPC OD to pay your uncle RM 250,000, when he quit the business. This is the reason you saw his personal account listed as an EPC current asset. To a certain extent, your father is an EPC debtor.”

Kim thought about this and asked, “Since my father’s personal current account has some money, why doesn’t he want to transfer the money to lessen EPC’s OD, in order to reduce the interest? The monthly interest is about RM2,300.” Shin Tian then explained, “Bank interest is costly because Chen Wha used the overdraft facility from RHB bank. RHB charges interest of the Base Lending Rate (BLR) +1.75; the BLR on 1 January 2009 was 5.55%, and was adjusted to 5.80% in March 2010. The interest was further adjusted to 6.05% in May 2010, and to 6.30% in July 2010. The latest BLR is 6.6%, due to an adjustment in May 2011.” He added this: “RHB bank provided an overdraft line of RM 350,000, with a mortgage on EPC’s premises; this was based on a market value of about RM 200,000, in 1997. The interest rate was reviewed, and lowered, by RHB, after Chen Wha claimed that he might shift his account to another bank, since RHB’s interest was high when compared to other banks. The new interest rate offered by RHB bank was BLR + 1.65, in May 2011. Thus, Chen Wha was satisfied with the new interest rate, and he was very happy that he had successfully convinced the bank to offer a better rate. However, 8.25% compounded interest is still relatively high on a fixed loan. Regarding why Chen Wha does not want to transfer money from his current account to reduce the interest, that is a personal matter, and I am not in a position to give any advice. He is sole proprietor. He is legally withdrawing the money from EPC, although it results in high interest and a tight cash flow.”

The summarized income statement and balance sheets for EPC for 2009, 2010 and 2011 are shown in Table 1 and Table 2. EPC had losses RM 21,444.77 in 2009, made a profit of RM 3798.58 in 2010, and lost RM 9025.29 in 2011.Total assets decreased from RM 1,391,234.92 in 2009 to RM 1,247,111.47 in 2010, and to RM 1,180,314.92 in 2011. Liabilities decreased from RM 1,079,578.76 to RM931,656.66 and RM877,949.70

Table 1: Income Statement of Easy Power Electrical Central for Years Ending 31 December (2009-2011)

| 2009 | 2010 | 2011 | ||||

| Revenue

less opening Stock Purchases & Hardware |

40,510 381,603 |

1,055,671 |

32,500 593,589 |

1,153,072 |

35,000 503,824 |

839,691 |

|

Less Closing stock Gross Profit Add Other Income |

422,113

32,500 |

389,613 |

626,089

35,000 |

591,089 |

538,824

34,500 |

504,324 |

| 666,058 | 561,983 | 335,367

158,450 |

||||

| 493,817 | ||||||

| Less Expenditure | ||||||

| Advertisement | – | 100 | 789 | |||

| Accounting fee | 560 | 480 | 480 | |||

| Allowance &

Overtime |

20,457 | 21,369 | 18,735 | |||

| Bank Charge | 287 | 140 | 119 | |||

| bank Interest | 21,869 | 14,380 | 23,157 | |||

| bonus & Red Packet | 11,800 | 17,400 | 5,560 | |||

| Contract Wages | 297,252 | 190,681 | 153,579 | |||

| Electricity and water | 12,722 | 2,552 | 9,441 | |||

| EPF | 11,580 | 14,257 | 13,300 | |||

| Food Allowance | 240 | 1,660 | 2,788 | |||

| Handling charge | 35 | – | 130 | |||

| Insurance | 886 | 886 | 890 | |||

| Interest (Finance) | 5,092 | 4,365 | 2,100 | |||

| Motor Fuel & Oil | 21,425 | 10,513 | 15,296 | |||

| Medical Fee | 1,614 | 2,285 | 3,012 | |||

| Newspaper | 444 | 413 | 341 | |||

| Office Expenses | – | 430 | 108 | |||

| Quit Rent &

Assessment |

885 | 835 | 833 | |||

| Road tax & Insurance | 4,063 | 6,670 | 4,137 | |||

| Repair&Maintenance-

car |

18,018 | 13,114 | 16,229 | |||

| Rental (hostel) | 1,800 | 1,950 | 980 | |||

| Stationery & printing | 1,234 | 1,886 | 404 | |||

| Socso | 2,635 | 3,246 | 2,218 | |||

| Sundry Wages | 5,100 | 1,600 | 600 | |||

| Salary (Proprietor) | 54,000 | 60,000 | 60,000 | |||

| Salary (employee) | 154,805 | 160,170 | 148,496 | |||

| Transport & Travel

Charge |

3,568 | 62 | 56 | |||

| telephone Charges | 9,756 | 5,355 | 6,962 | |||

| Uniform for worker | – | – | 600 | |||

| Upkeep: Air cond,PC | – | – | 735 | |||

| Depreciation | 23,927 | 12,833 | 10,768 | |||

| Donation | 200 | – | – | |||

| Foreign Worker Levi

fee |

1,250 | 3,400 | – | |||

| Late Interest Charge | – | 1,344 | – | |||

| Licence | – | 930 | – | |||

| Worker

Accommodation |

– | 687,503 | 2,880 | 558,185 | – | 502,842 |

| Net Profit/ Loss | -21,445 | 3,799 | -9,025 |

Table 2: Balance Sheets of Easy Power Electrical Central for Years Ending 31 December (2009-2011)

| 2009 | 2010 | 2011 | ||||

| Non-Current Asset | 405,605 | 397,351 | 393,741 | |||

| Current Asset | ||||||

| Closing Stock | 32,500 | 35,000 | 34,500 | |||

| Deposit | 1,143 | 1,143 | 1,143 | |||

| Maybank | 119 | 119 | 119 | |||

| Trade Debtors | 612,022 | 668,098 | 624,973 | |||

| Sundry Debtors | 24,928 | 22,665 | 23,830 | |||

| Personal C.Account | 314,836 | 122,434 | 100,793 | |||

| Cash in Hand | 81 | 985,630 | 301 | 849,761 | 1,215 | 786,574 |

| 1,391,235 | 1,247,111 | 1,180,315 | ||||

|

Current Liabilities |

||||||

| Accruals | 11,026 | 20,849 | 77,126 | |||

| Trade Creditors | 621,669 | 569,724 | 502,362 | |||

| RHB | 206,352 | 263,162 | 230,522 | |||

| Sundry Creditors | 179,475 | 36,278 | 36,305 | |||

| Am Bank(car loan) | 61,056 | 1,079,579 | 41,644 | 931,657 | 31,636 | 877,950 |

|

Owner Equity |

||||||

| Capital | 500,000 | 500,000 | 500,000 | |||

| Profit & lost account | ||||||

| Balance b/d | -166,899 | -188,344 | -184,545 | |||

| Profit/loss for the year | -21,445 | 3,799 | -9,025 | |||

| -188,344 | -184,545 | -193,570 | ||||

| Drawings (Income Tax) | – | -188,344 | -184,545 | 4,064 | -197,635 | |

| 1,391,235 | 1,247,111 | 1,180,315 | ||||

HARD WORK AS CHARITY?

Guang identified a declining trend with trade creditors, but no significant changes with trade debtors. He felt Chen Wha was too kind to his debtors. Thus he printed out the Top 7 EPC debtors, shown on Table 3. He was shocked when he saw the total debt of RM 437,989.99, which not been paid for more than two years.

Table 3: EPC Top 7 Debtors as of 31 December 2011

| NO | COMPANY | AS AT 31/12/2011 |

| 1 | MANICHI ELECTROCNIC (M) SDN BHD | 17,680.00 |

| 2 | EARN EXTRA SDN BHD | 297,828.63 |

| 3 | WINNER FIBRES IND SDN BHD | 40,365.01 |

| 4 | LEGEND DEVELOPER SDN BHD | 20,544.75 |

| 5 | KACANG PUTIH SDN BHD | 25,571.60 |

| 6 | PEMBINAAN BUMI (S) SDN BHD | 21,950.00 |

| 7 | SIVARAJAN CONSTRUCTION SDN BHD | 14,050.00 |

| TOTAL | 437,989.99 | |

Chen Wha checked for legal consultants, and found that the legal firm issued a lawyer’s letter to the debtors in January 2009. He got a response from PEMBINAAN BUMI (S) SDN BHD only; the installment was paid. But he received no responses from the others. And thus far Chen Wha has not taken any further action. Guang took the printed report and showed it to Chen Wha. He said to him, “Dad, I found a way to increase our working capital. If we manage to receive 75% of the total owed by these top seven debtors, we can settle the bank OD.” Chen Wha read the printed report and replied, “I tried before, and it is not as easy as you think. Earn Extra SDN BHD is a company that registered under my name. I had legal letters issued to the other six debtors, but I only got feedback from PEMBINAAN BUMI. It will be very costly if I take further action against another five debtors.”

He continued, “Besides, I heard that MANICHI and SIVARAJAN are already bankrupt. Even if these companies are not bankrupt, what will happen if we win the cases and the companies are not able to pay? There is a possibility that a company SDN BHD has a value of only RM 2. If so, we still need to pay the legal fees. Thus, it is better to convince them to pay back the money rather than take further action.”

Guang was disappointed with Chen Wha’s position. After hearing it, he slowly took out the refinancing plan shown in Table 4, that was offered by several bankers. He then asked Chen Wha, “Why don’t we refinance the Bank OD as a fixed loan?” Chen Wha took a few minutes and then said, “Interest is not a big deal to business in the world. Do you really think everything will be fine after refinancing the loan? Please concentrate on finding new customers.” At that point, Guang quietly left the office.

Table 4: Bank Offer- Personal Loan Plan for Chen Wha

| Bank \ Property | EPC Shop | |

|

UOB Bank |

Value | 350000 |

| Borrowing Margin | 80% | |

| Borrow amount | 280000 | |

| Interest | BLR – 2.1 | |

| Installment period | 35 years | |

|

Public Bank |

Value | 280000 |

| Borrowing Margin | 80% | |

| Borrow amount | 224000 | |

| Interest | BLR – 2.2 | |

| installment period | 30 years | |

|

Maybank |

Value | 350000 |

| Borrowing Margin | 80% | |

| Borrow amount | 280000 | |

| Interest | BLR – 2.1 | |

| installment period | 30 years | |

*UOB and Maybank are using the same values.

A COMPANY OUT OF CONTROL

EPC provided professional electrical services. Most of the time the electrical supervisor and technician worked outside. This had been a challenge for Guang to manage and supervise employee performance.

Sometimes he did spot-check and found that two employees were not in their working areas during their working hours, and the next working day, the employees both claimed two hours’ overtime pay. This made Guang very angry, and he reduced the overtime pay for the two employees, for that particular month, and followed by punishing all employee by not allow overtime from then onward.

Over the next three months employees made frequent appeals to Chen Wha, as the overtime pay-cut significantly affected their income. Finally, Chen Wha allowed employees to again claim overtime.

Additionally, some employee had been caught doing personal things during working hours (e.g., bank transactions, shopping, resting at mamak restaurants,

staying home, etc.). Once they were caught, the employee would have plenty of excuses, and most of the time they had only been warned.

Furthermore, some employees accepted jobs from customers privately, by offering them cheaper rates. This directly injured the company and was illegal. The employees, when caught, argued that they did such things only after their working hours, and that the company should not interrupt their dealings. As a result, some customers would not deal with EPC, as they preferred cheaper charges over ethical behavior.

Again, Guang felt that he had to do something to stop this kind of behavior. He went to Chen Wha with the report which showed the salary structure and job descriptions, as in Table 5. He said, “Dad, we have to do something. Yesterday I met Azlan in Ambank at 10.30am. He was doing some kind of bank transaction. But I called him fifteen minutes earlier, and he had told me he was troubleshooting in Hai Tong Sdn Bhd—which is more than ten kilometers from the bank. He is cheated the company.”

He continued: “Also, I saw Terry last Wednesday at 5pm, on the way back to his house on a bicycle, but the next day he reported that he did three hours’ overtime. They lie to me and they cheat the company! We must do something to control this situation. What can we do to punish them, and stop this from happening?”

Chen Wha replied, “How come this happened again? I already told them to be hard working, and that I will reward them big better bonuses. The only thing we can do is spot-check more frequently. We can do nothing else because we cannot afford to lose any one of them. Also, you inform Terry that his overtime for this month will be fully deducted.”

Guang concluded: “I understand that overseeing employee performance is part of my job, and I think that the current system is not sufficient to improve performance and progress. Currently we have a kind of unofficial ‘reward system.’ The year-end bonuses are already a reward system; if we have another reward system it will incur extra cost. I understand you are trying to do help the company, but the employees will only try their best to take advantage of us. Furthermore, I know that some of them have accepted private jobs from our customers. So I don’t think now is the time to increase employee benefits.”

EPILOGUE

Chen Wha met with the financial consultant from Intra Harta Sdn. Bhd., to objectively identify the causes for the company’s poor financial performance, and to improve cash flow and improve employee efficiency. Chen Wha promised himself that he would not let the EPC business collapse, because this was also his father’s accomplishment. He resolved that he would turn around its operation.

For REF… Use: #getanswers2002187