Strategic Financial Management Assessment Help

Are you looking for the Best Strategic Financial Management Assessment Questions and Answers Help? We offer an online assignment service, so every student in Australia at any place can avail of our assistance. Do visit Assignmenthelpaus.com for assignment writing services. If you need Strategic Financial Management Assessment Help so, place your order now!

Assignment Details:

- Words: 2500

Summary

Write a 2500-word report based on the given financial scenario and financial information provided. Conduct the strategic financial analysis using the information provided and the appropriate techniques, tools and frameworks. Make decisions and recommendations based on the analysis, considering all relevant implications, challenges and limitations.

Learning outcomes

1. Demonstrate understanding of core contemporary financial management theory, techniques and practice.

2. Critically evaluate and effectively communicate recommendations to address financial management issues.

3. Apply financial management theory and techniques to professional practice in an ethical manner.

Task

Context

GrowBetter (GB) is a listed Canadian company deriving revenue from the manufacture and distribution of high-performance organic fertiliser pellets exclusively to wholesale customers. GB has been greatly affected by the COVID-19 pandemic and the demand for organic fertiliser pellets has decreased rapidly with revenues and profits at historically low levels.

To overcome the challenges stemming from the COVID-19 situation, the marketing department has done intensive research and suggested an aggressive 5-year marketing strategy whereby the credit terms to all customers will be relaxed from 30 days to 60 days, in conjunction with other marketing campaigns across Africa, Asia, and Latin America. This campaign will involve an additional marketing fixed cash expense of $120,000 per year is expected to generate additional sales of 3,000 tonnes per year.

To accommodate the extra demand created by the marketing campaign, GB is comparing two mutually exclusive investment projects. The Project A is less risky as it would involve the expansion of existing facilities and requires a smaller initial investment. The Project B involves higher investment but reduces the current variable cost of production. Both investment projects would have a five-year usable life and would be depreciated over their life using the straight-line depreciation method (assuming no salvage value). The total annual fixed cost will be the sum of marketing fixed cash expense of $120,000 per year (mentioned above) and annual depreciation (a non-cash expense) for each project.

The production manager has produced estimates for the costs associated with the manufacturing of the product. The current variable cost of producing a tonne of fertiliser is $315 per tonne, which would remain the same under Project A but is estimated to fall to $260 per tonne in the case of Project B. The total variable cost includes raw material, labour and other production costs. The selling price of the product is $500 per tonne.

As per the above forecasts (assume they remain the same every year) and the 5-year marketing campaign, the estimated free cash flows generated by the two projects are given below:

Table 1. The estimated free cash flows for Project A and Project B

| Year | Project A | Project B |

| 0 | ($500,000) | ($950,000) |

| 1 | $334,500 | $477,000 |

| 2 | $334,500 | $477,000 |

| 3 | $334,500 | $477,000 |

| 4 | $334,500 | $477,000 |

| 5 | $334,500 | $477,000 |

Note: The above-mentioned estimates reflect all associated revenues/costs. Ignore the change in working capital and assume revenue/costs are constant over time.

Based on the weighted average cost of capital (WACC) of GB, its Chief Financial Analyst has estimated the required rate of return to be 6%.

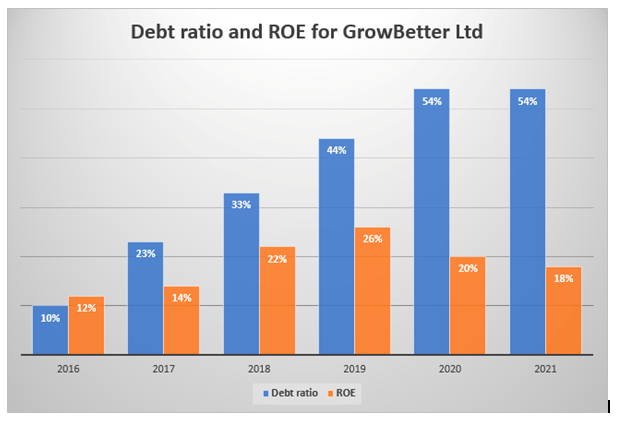

To finance the marketing campaign and the expected increase in production, BG will need to raise additional finance in the form of debt and/or equity. BG’s debt ratio and return on equity (ROE) ratio over 2016-2021 are provided in the graph below:

Figure 1. The debt ratio and return on equity (ROE) for GrowBetter Ltd over 2016-2021

As GB’s Chief Financial Officer (CFO), you are required to prepare a report addressing the following questions:

1. Explain the usefulness of cash and accounting break-even points as management tools. Based on the forecasted increase in sales, do Project A and Project B meet the corresponding cash and accounting break-even points? Explain why.

2. Discuss the implications of the proposed relaxation of credit terms to customers from 30 days to 60 days on GB’s working capital management.

3. Explain the usefulness of simple Payback period, and Net Present Value (NPV) as investment appraisal tools. Compute the simple Payback period and NPV for Project A and Project B and discuss which Project is better and why. Use the payback cut-off period of 2 years for the evaluation of the payback period, and 6% as the discount rate to calculate NPV. What other factors should GB consider in selecting between Project A and Project B? Explain why.

4. Comment on GB’s debt ratio and ROE and its trend over time. How should GB finance the chosen project? Explain why using finance principles introduced in this subject.

5. Based on the answers to Questions 1 through 4 above, make specific recommendations to the Board. Include limitations of the analyses conducted.

Example report structure

The following is a suggested structure only.

Cover Page

Executive summary

Table of Contents

1. Introduction (about 200 words)

2. Breakeven analyses (about 400 words)

3. Working capital management (about 400 words)

4. Project evaluation (about 750 words)

5. The funding choice (about 400 words)

6. Recommendations and limitations (about 350 words)

References

Other requirements

● You are required to use at least five (5) academic references for this report (in addition to any references covering data sources).

● Your references should be from credible sources such as books, industry-related journals, magazines or academic journal articles.

● The report format should follow the AIB Style Guide (i.e., cover page including your name and student ID, title and word count; executive summary; table of contents; body; list of references; and appendix, if needed).

● Please refer to the 8006FMGT Assessment Exemplar for how to structure your presentation and arguments in this assessment. In each section of your report, please define the financial concepts and/or critical theories before calculations/analyses.

● Use the AIB Report Template to format your report, or use the AIB-preferred Microsoft Word settings (see page 34 of the AIB Style Guide).

● The assessment grade will be adversely affected if the report word count exceeds the allowed 2,500 words plus 10% tolerance (see Assessment Policy available on the AIB website)

● The provided Formula Sheet contains the relevant formulas from the textbook.

Grading criteria and feedback

Your assessment will be marked according to the following grading criteria:

1. Criterion 1: Breakeven analyses – 15%

2. Criterion 2: Working capital management – 15%

3. Criterion 3: Project evaluation – 30%

4. Criterion 4: The funding choice – 15%

5. Criterion 5: Recommendations and limitations – 15%

6. Criterion 6: In-text citations and referencing – 5%

7. Criterion 7: Communication, presentation, structure and language – 5%

For REF… Use: #getanswers2002217