Looking B326 TMA Spring 19-2020: Advanced Financial Accounting Assignment Answers? Grab the opportunity to find assignment sample related to all subjects in your Academic. Assignmenthelpaus.com is proud to offer online assignment help to the students of Australia, UK and USA.

B326: Advanced Financial Accounting

TMA – Spring 2019-2020

Cut-Off Date: As decided by the Deanship

About TMA:

The TMA covers the advanced accounting concepts and practices in the businesses. It is marked out of 100 and is worth 20% of the overall assessment component. This TMA requires you to apply the course concepts. The TMA is intended to:

- Assess students’ understanding of key learning points within chapter 1, 3, 4 and

- Increase the students’ knowledge about the reality of the advanced Accounting issues.

- Develop students’ communication skills, such as memo writing, essay writing, analysis and presentation of material.

- Develop the students’ ability to understand and analyze different issues that corporations might face in real world.

- Develop basic ICT skills such as using the internet.

The TMA:

This TMA is divided into four parts.

The TMA requires you to:

- Review various study chapters in addition to supplementary materials.

- Conduct a deep information search using the internet and your E-Library. You are expected to use E-library sources to support your answers. A minimum of 3 sources is required.

- It’s imperative that you write your answer using your own words. Plagiarism will be penalized depending on its severity and according to AOU plagiarism policy.

- Present your findings in not more than 2,000 words.

- You should use a Microsoft Office Word and Times New Roman Font of 12 points.

- You should use Harvard referencing style for in-text citation and list of references.

For Cut-off date: Check LMS

Criteria for Grade Distribution:

| Criteria | Content | Referencing & E-library | Structure and Presentation of ideas | Total marks | ||||

| Part A | Part B | Part C | Part D | Part E | ||||

| Marks | 25 | 20 | 25 | 15 | 15 | (5) | (5) | 100 |

The TMA Questions

PART A:

Each year, the Microsoft Corporation produces a detailed Annual Report, which contains among other items, 1) the Consolidated Financial Statements of the Microsoft Company, 2) the Corporate Governance Report, and 3) the Compensation Report.

Access theMicrosoft Company home web page and download:Microsoft10-K for 2019

Note: this file is available at:

https://c.s-microsoft.com/en-us/CMSFiles/MSFT_FY19Q4_10K.docx?version=0a785912-1d8b-1ee0-f8d8-63f2fb7a5f00

Instructions: In light of your study of the course subjects andyour readings through(the Internet – Microsoft Corporation annual report 2019 – the university e-library), answer the following questions:

(Always support your answer with suitable figures from the Microsoft Corporation’s annual report.)

- How does Microsoft Corporation account for Goodwill, and Other Intangible Assets? (5 marks)

- In which financial statement does Microsoft Corporation record goodwill & other intangible assets? (State the numbers for Goodwill in 2018 and 2019) (5 marks)

- How much impairment charges related to goodwill and other intangible assets did Microsoft Corporation report in 2019 & 2018? In which financial statement these charges should be reported? (2.5 marks)

- Determine the total amount of non-controlling interest for 2019 and state in which statement it is disclosed (2.5 marks)

- Does Microsoft Corporation make any acquisitions during Fiscal year 2019?. How much it cost Microsoft?. How much goodwill recognized on connection with this acquisition, and to which segment it was assigned?. (10 marks)

PART B:

In 2015 Microsoft Corporation reported a $5.1 billion charge for the impairment of goodwill and a $2.2 billion charge for the impairment of intangible assets in one of its reporting units (segments) in its 10-K annual report. Referring to Microsoft’s 2015 financial statements and any other information from the media, address the following:

- Microsoft’s segments serve as its reporting units for assessing goodwill for potential impairments. Which segment suffered a 2015 impairment? Describe the revenue model for this segment. (5 marks)

- What were the underlying business reasons that required Microsoft to record a goodwill impairment in 2015?(5 marks)

- How did Microsoft reflect the 2015 goodwill impairment in its income statement and cash flow statement?(5 marks)

- Describe in your own words the goodwill impairment testing steps performed by Microsoft in 2015 and the consequent loss measurement. (5 marks)

PART C:

Briefly explain the differences between the IFRS and GAAP (after FASB issued ASU 2017-04 to simplify the accounting for goodwill impairment) regarding the following:

- Assignment/allocation of goodwill. (i.e. The levels at which goodwill is assigned/allocated.

- Impairment of goodwill,test(s) applied, how impairment loss is recognized and allocated (In case the impairment loss exceeds [or does not exceed] the carrying value of goodwill), and reversal of impairment.

- Amortization and impairment of intangible assets other than goodwill

- Non-Controlling interest.(25 marks)

Answer this question in a tabular format, like the following one:

| IFRS | GAAP | |

| Assignment/allocation of Goodwill | ||

| Impairment of goodwill | ||

| …..etc |

(You must support your answer in this question with quality references.)

PART D:

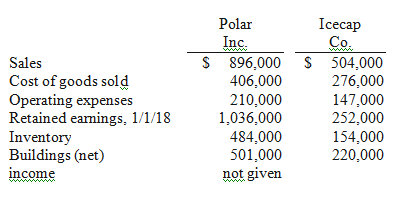

Several years ago Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap’s asset and liability accounts at that time were considered to be equal to their fair values. Polar’s acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transfer.

The following selected account balances were from the individual financial records of these two companies as of December 31, 2018:

Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2017 and $112,000 in 2018. Of this inventory, $29,000 of the 2017 transfers were retained and then sold by Polar in 2018, whereas $49,000 of the 2018 transfers was held until 2019.

Required:

For the consolidated financial statements for 2018, determine the balances that would appear for the following accounts: (i) Cost of Goods Sold; (ii) Inventory; and (iii) Net income attributable to the non controlling interest.

(15 marks)

PART E

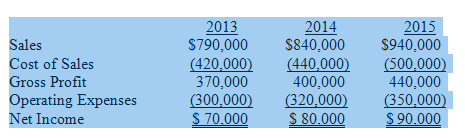

Plover Corporation acquired 80% of Sink Inc. equity on January 1, 2013, when the book values of Sink’s assets and liabilities were equal to their fair values. The cost of the investment was equal to 80% of the book value of Sink’s net assets.

Plover separate income (excluding Sink) was $1,800,000, $1,700,000 and $1,900,000 in 2013, 2014 and 2015 respectively. Plover sold inventory to Sink during 2013 at a gross profit of $48,000 and one quarter remained at Sink at the end of the year. The remaining 25 percent was sold in 2014. At the end of 2014, Plover has $25,000 of inventory received from Sink from a sale of $100,000 which cost Sink $80,000. There are no unrealized profits in the inventory of Plover or Sink at the end of 2015. Plover uses the equity method in its separate books. Select financial information for Sink follows:

Required:

Prepare a schedule to determine the controlling interest share of the consolidated net income for 2013, 2014, and 2015. (15 marks)

Arab Open University

B292: TMA – 2nd Semester 2019-2020

Cut-Off Date: April, 2020

About TMA:

The TMA covers the management accounting concepts and practices in the businesses. It is marked out of 100 and is worth 20% of the overall assessment component. It is intended to assess students’ understanding of some of the learning points within units 1, 2, 3, 4 and 6 beside the supplementary material. This TMA requires you to apply the course concepts. The TMA is intended to:

- Assess students’ understanding of key learning points within units 1, 2, 3, 4 and 6.

- Increase the students’ knowledge about the reality of the Managerial Accounting as a profession.

- Develop students’ communication skills, such as memo writing, essay writing, analysis and presentation of material.

- Develop the ability to understand and interact with the nature of the managerial accounting tools in reality.

- Develop basic ICT skills such as using the internet.

The TMA requires you to:

- Review various study sessions beside the supplementary materials.

- Conduct a simple information search using the internet.

- Present your findings in not more than 2,000 words± 10%.

- You should use a Microsoft Office Word and Times New Roman Font of 12 points.

- You should read and follow the instructions below carefully. Each part of the process will carry marks for the assignment.

Criteria for Grade Distribution:

| Criteria | Content | Referencing | Structure and Presentation of ideas | Total marks | ||

| Part A | Part B | Part C | ||||

| Marks | 40 | 60 | 5 | 5 | 100 | |

PART A: What Management Accountants Do?

- Jobs for Management Accountants: Undertake a search for management accounting jobs on Google. List examples of positions that could be filled by management accountants.( 8 marks)

- Management accountants are often hired as consultants for a contracted period. List the most common roles that management accountants play. (8 marks)

- Discuss how financial and managerial accounting interface. Is one more important than another? Discuss the rationale for your answer. (8 marks)

- Describe the personal characteristics you would find to be effective as a management accountant.( 8 marks)

- External Focus of Management Accounting: Historically, finance professionals have tended to concentrate internally within their organization and rather ignored the external environment. Strategic management accounting (SMA) has begun to change this emphasis and many of the techniques in your Management accounting handbook have strategic management accounting elements. Describe at least four issues or concerns that have an external focus from the Management Accountants.( 8 marks)

Part B

Budgeting and Break even in Sanyo Industries

Sanyo Industries is making industrial products. The company has been growing nicely in terms of revenue and its customer base. The Board of Directors of Sanyo Industries has been insisting that they should have one management accountant for their company to achieve better performance in the coming periods. The role of management accountants has been well-known to the corporate world as they widely contribute for performing planning, controlling and decision making functions effectively and efficiently through providing solid accounting information with good analysis.

Production and Cost Details

Sanyo Industries manufactures and sells a single product that has following cost and selling price structure:

| Information | $ per unit | |

| Selling Price | 500 | |

| Direct Material | 300 (per unit of material) | 300 |

| Direct Labour cost | 50 per hour | 300 |

| Number of labour hours needed to manufacture one unit of product | 6 hours | |

| Fixed Costs for the company | $ 40,000 |

Estimations for the next year 2020

The company has estimated the following for the next for one of its products (Beta).

(i) Sales Estimations

| First Quarter | Second Quarter | Third Quarter | Fourth Quarter | |

| Number of units to be sold (Units) | 1000 | 1100 | 1200 | 1300 |

(ii) Inventory estimations

| Inventory | Beginning

(first quarter) |

Ending |

| Finished Goods | 200 units | The company desires to have an ending inventory each quarter equal to 25% of the next quarter’s sales. The first quarter’s sales for the following year (2021) is expected to be 1400 units |

| Materials | $ 120,000 | The company desires the ending balance in materials inventory to be 45% of the next quarter’s cost of materials. The cost of materials for the first quarter in the following year (2021) is expected to be $ 170,400 |

(1) Based on the estimated information given above, prepare

(i) Sales Budget (5 marks)

(ii) Production Budget(15 marks)

(iii)Direct Materials Cost Budget (15 marks)

(iv)Direct Labor Cost Budget (15 marks)

(2) Calculate the BEP in units for this company based on the cost and sale per unit information given above. If their current operating level is 900 units, is this company making profit or not? Prove your answer (10 marks)

Reference ID: #getanswers2001141