If you are thinking about ordering high quality, plagiarism free assignment without making any hole in the pocket, Assignmenthelpaus.com is the right place for you. Here 3000+ expert professionals work hard to get your assignment done on time, 100% satisfaction in Case Study Helper and Dissertation Writing can aid the students of Australia, UK and USA.

Assignment Details:

Document Type :: Assignment help (any type)

Subject :: Accounting

Deadline :*: As Per Required

Number of Words :: As Per Required

Citation/Referencing Style :: As Per Required

Part A

Answer any FIVE (5) out of SEVEN (7) questions. 15 x 5 = 75 marks

Essay questions

1). Assume that you have received copies of the financial statements for PepsiCo for the years ending December 31, 2014 and 2013. Answer the following questions:

a). If you were a banker, why would you need information from PepsiCo’s financial statements?

b). If you were a potential investor in PepsiCo stock, what information would you want from their financial statements?

c). If you were a labor negotiator for a union that represents a group of PepsiCo’s employees, which financial statement would provide you with the most useful information?

2) Determine what accounting assumption principle has been violated in each situation below:

- Melissa is the owner of Missy’s Tea Shop, a sole proprietorship. She purchases a new computer for her personal use at home. Melissa records the computer as an asset of Missy’s Tea Shop.

- Houston Electronics purchased an office building several years ago for $500,000. The office building could be sold today for $850,000. The accountant will now show the building as an asset on the books for $850,000.

- Henry is a new accountant for Acme Foods. He is extremely busy and has decided that he can prepare the financial statements every two years.

- The Candle Store is having financial problems. It has no plans to liquidate, but decides to use market value to report their assets since they plan on moving to a smaller store.

3). You evaluate loan requests as part of your job at Eastwood National Bank. One loan request you received is from Surfer Dude Supplies, a small company. Richard Tracy, the CEO, is requesting $105,000 and brings you a statement of accounts for his first year of operations ended December 31.

4). Dividends, you have learned, are a distribution of income, not an expense. What is the difference? Why can’t the corporation list them as an expense, since dividends are just another amount of money paid out to somebody?

5). Read the following case and answer the questions that follow:

GeoPetro is independent oil and natural gas Company with headquarters in San Francisco, California. It recently received an audit opinion that expressed a going concern paragraph. The following is an excerpt from GeoPetro’s 2012 report:

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has incurred recurring net losses that have resulted in an accumulated deficit of $49.7 million as of December 31, 2012. Also, the Company has limited cash and working capital to fund its future operations. These factors raise substantial doubt about the ability of the Company to continue as a going concern. Management’s plans regarding those matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties.

Required:

- What is the general purpose of an auditors’ report?

- What is a going concern? Define it in your words, don’t quote the book.

- Are losses, restructuring, and the disposal of segments necessarily precursors to the demise of the company?

- What, in your words, are the auditors saying about these particular companies?

6). All businesses are subject to various types of legal proceedings. Merck & Co. Inc., a global health care company that manufacturers prescription medicines, has been a defendant in a number of product liability lawsuits. In the notes to Merck’s 2012 financial statements, the company states: “There are various other pending legal proceedings involving the Company, principally product liability and intellectual property lawsuits. While it is not feasible to predict the outcome of such proceedings, in the opinion of the Company, either the likelihood of loss is remote or any reasonably possible loss associated with the resolution of such proceedings is not expected to be material to the Company’s financial position, results of operations or cash flows either individually or in the aggregate.”

Required:

Explain in your own words what Merck means by this statement. In particular, include what they mean by “material” and “remote.” Who is in the best position to determine the outcome of a lawsuit?

7). Presented below are condensed data from the financial statements of Unique Factory for 2015 and 2014. The figures are expressed in thousands. Use this information to answer the questions that follow.

| Statement A | 2015 | 2014 |

| Total current assets | $ 82,309 | $ 80,080 |

| Property, plant & equipment | ||

| (net of accumulated depreciation) | 63,451 | 62,724 |

| Investments | 303 | 1,061 |

| Other assets | 3,438 | 2,606 |

| Total assets | $149,501 | $146,471 |

| Total current liabilities | $ 33,928 | $ 28,668 |

| Long-term debt | 20,491 | 25,676 |

| Deferred income taxes and contingencies | 4,174 | 5,208 |

| Total liabilities | $ 58,593 | $ 59,552 |

| Total stockholders’ equity | 90,908 | 86,919 |

| Total liabilities & stockholders’ equity | $149,501 | $146,471 |

| Statement B | 2015 | 2014 |

| Net sales | $209,203 | $174,206 |

| Cost of sales | 136,225 | 114,284 |

| Gross profit | 72,978 | 59,922 |

| Selling, general and administrative expenses | 63,895 | 53,520 |

| Other income (expense) | 693 | (118) |

| Income (loss) before income taxes | 9,776 | 6,284 |

| Income tax expense | 3,534 | 2,388 |

| Net income (loss) | $ 6,242 | $ 3,896 |

Required: Based on the information provided, is Unique Factory considered a business or non-business entity? How do you know by examining the financial statements?

Part B

Answer any five (5) out of EIGHT (8) questions. 5 x 5 = 25 marks

Exercise 1

Brock Corporation’s end of year balance sheet consisted of the following amounts:

| Cash | $ 25,000 | Accounts receivable | $ 46,000 |

| Property, plant & equipment | 69,000 | Long-termdebt | 41,000 |

| Capital stock | 100,000 | Accounts payable | 24,000 |

| Retained earnings | ? | Inventory | 33,000 |

Required: What is Brock’s total liabilities balance at the end of the current year?

Exercise 2

We i Company reported the following items on its financial statements for the year ending December 31, 2015:

| Sales | $560,000 | Cost of goods sold | $400,000 |

| Salary expense | 40,000 | Interest expense | 30,000 |

| Dividends | 20,000 | Income tax expense | 25,000 |

Required: What is the net income for the company?

Exercise 3

Presented below are selected data from the accounting records for Micco’s Gift Store for 2014.

| Net sales | $ 190,000 | |

| Income taxes | 30,000 | |

| Cost of sales | 80,000 | |

| Operating expenses | 45,000 | |

| Dividends | 12,000 |

Required:

a). Calculate the net income or loss for 2014.

b). Explain how the amount from part “A” will affect the financial position of Micco’s Gift Store.

c). Is the company profitable? Explain your answer.

Exercise 4

Classify the following items according to the financial statement on which each belongs, either the income statement (IS) or the balance sheet (BS). Also indicate whether reach is are venue (R), expense (E), asset (A), liability (L), or owners’ equity (OE) item.

| Appears on Which Statement? | Type of Account | |||

| 1. | Retained earnings | _________________ | _________________ | |

| 2. | Buildings | _________________ | _________________ | |

| 3. | Common stock | _________________ | _________________ | |

| 4. | Accounts payable | _________________ | _________________ | |

| 5. | Football ticket sales | _________________ | _________________ | |

| 6. | Salaries expense | _________________ | _________________ | |

| 7. | Accounts receivable | _________________ | _________________ | |

Exercise 5

Following accounts are related to Galaxy Corporation for the year ended December 31, 2016:

| Sales revenue | $165,000 | Cash | $ 30,000 |

| Accounts receivable | 14,000 | Selling expenses | 44,000 |

| Equipment | 42,000 | Common stock | 41,000 |

| Accounts payable | 12,000 | Interest income | 3,000 |

| Salaries and wages expense | 40,000 | Cost of sales | 51,000 |

| Inventories | 22,000 | Prepaid expenses | 2,000 |

| Income taxes payable | 5,000 | Income taxes expense | 18,000 |

| Notes payable | 20,000 | Retained earnings | ? |

Read the information for Galaxy Corporation. Determine the following amounts for Galaxy Corporation:

a) Total assets at the end of 2016 _________________________

b) Total liabilities at the end of 2016 _________________________

c) What parties have acclaim on Galaxy Corporation’ assets? Explain you answer in the terms of the accounting equation.

Exercise 6

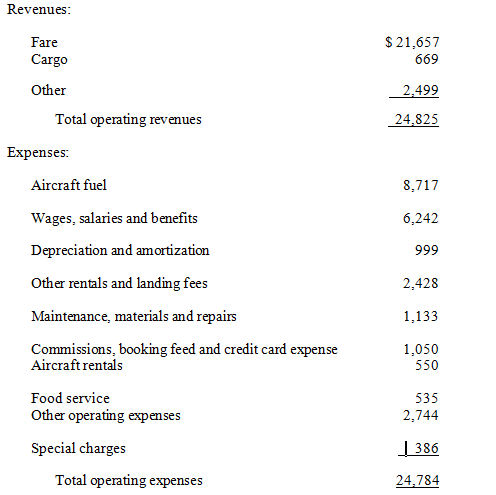

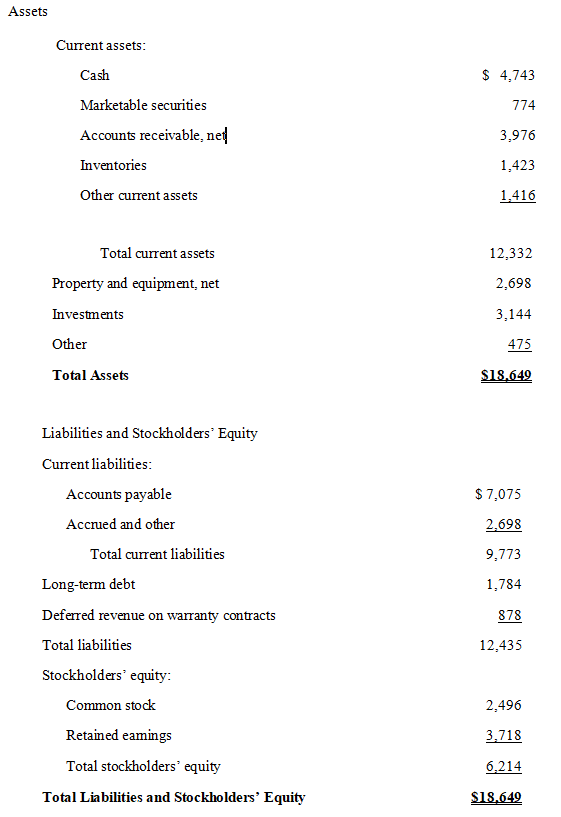

Carefully look over the following financial statement from an actual company.

Bronz Corporation

Consolidated Statement of Operations

Year Ended December 31, 2012

($ millions)

Required:

- Which financial statement is this? Did the title confuse you, or is it an accurate description of what follows? Do you think it is better than the title you are accustomed to?

- Does this business appear to be a retailer, a manufacturer, or a service company? How can you tell?

- What business do you believe they are in? Again, what tells you this?

- Can you calculate gross profit for this company? Why or why not?

Exercise 7

For each item given below, explain why the account requires a subsidiary ledger, and what information would be given for each entry in this subsidiary ledger.

Exercise 8

Use the following transactions for ABC Company and answer the questions listed below:

- ABC purchases shoes from Nike on credit.

- ABC returns defective shoes to Nike before payment is made to Nike for the shoes purchased in transaction A.

- ABC pays for the shoes purchased from Nike.

- ABC sells shoes to its customers for cash and on credit.

- Credit customers return shoes to ABC for are fund.

- Credit customers pay their account balances to ABC.

Required: For each transaction described above, describe the economic effects of the transaction on the company under periodic inventory system.

Reference ID: #getanswers2001005