Financial Management Assignment Answers to Questions

Assignment Details:-

- Number of Words: 3500

Answer all the Questions

Question 1

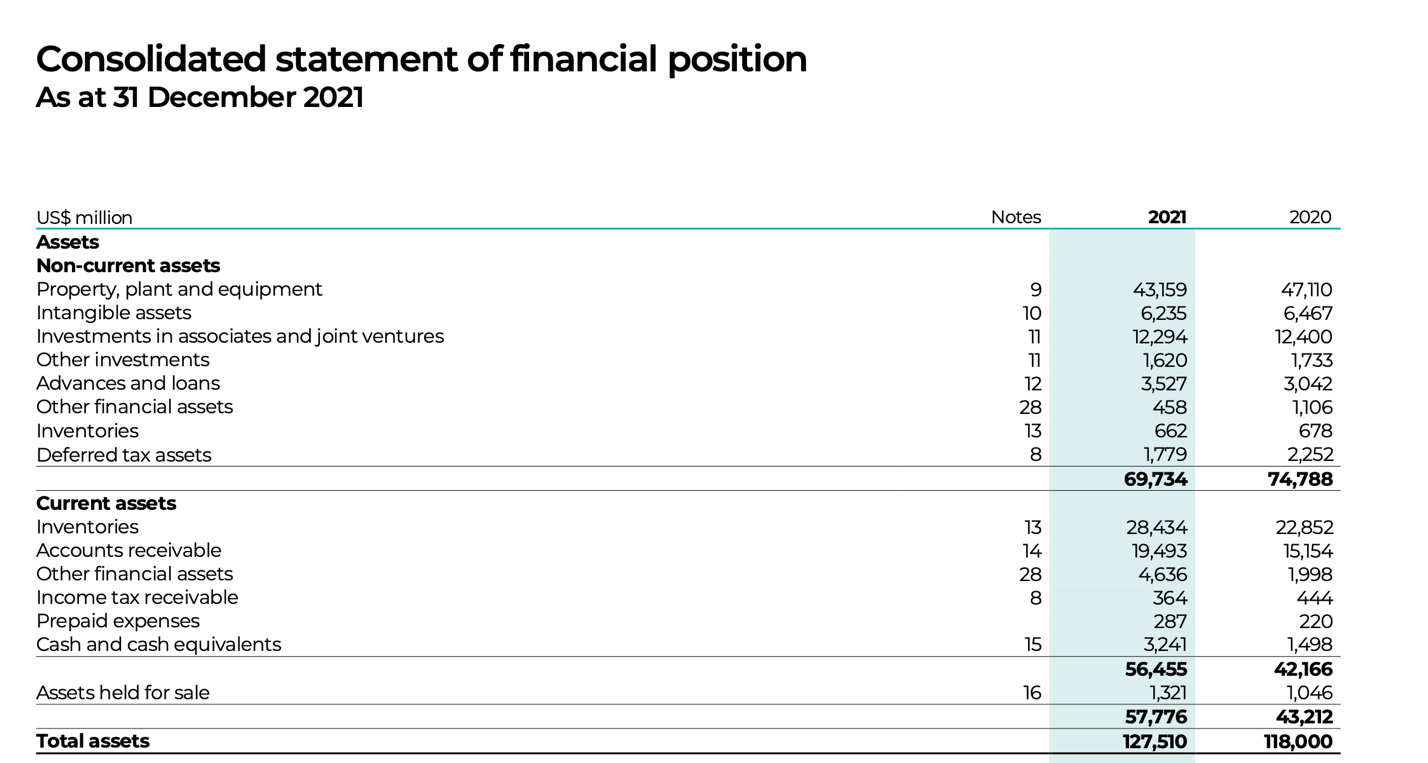

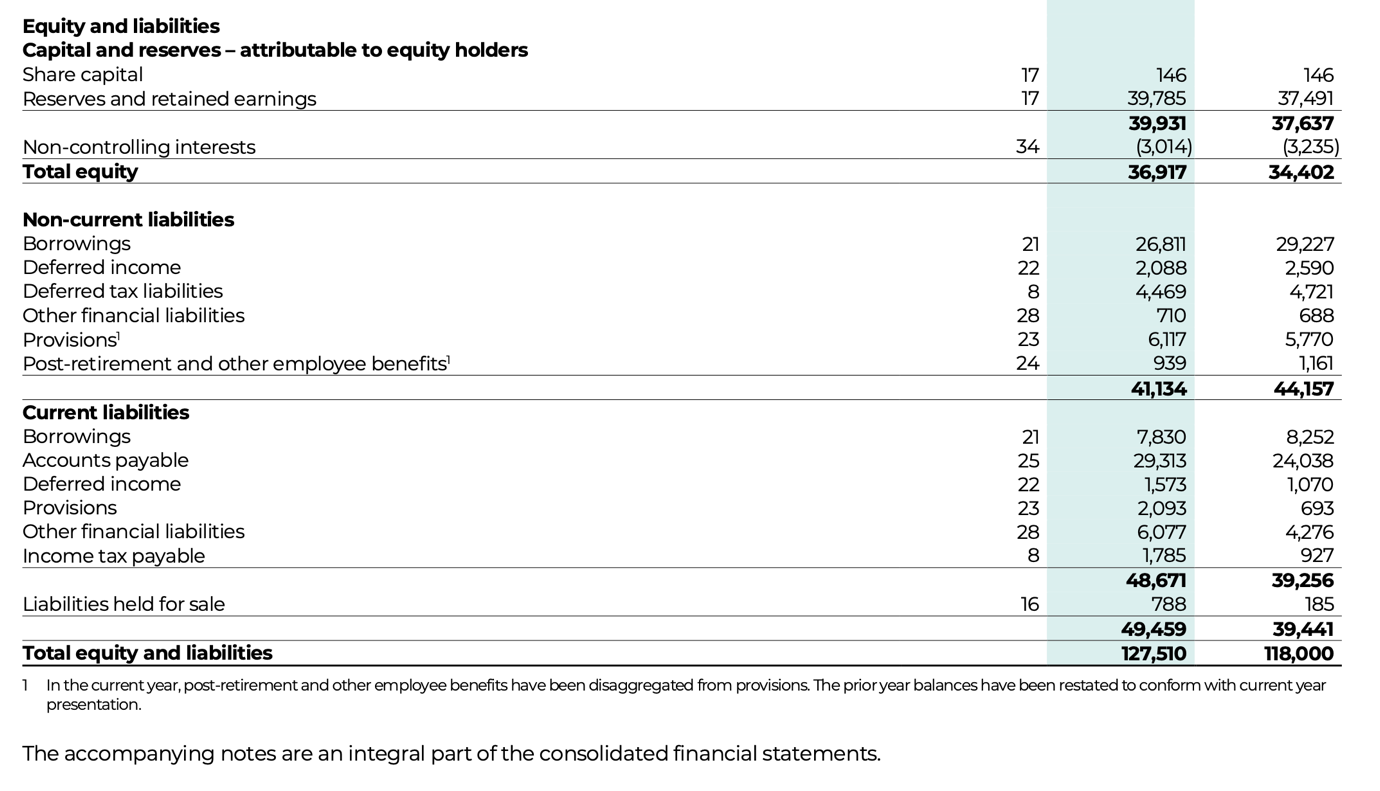

See Appendix 1 Glencore Plc 2021 Financial Accounts

a. Calculate the following ratios for 2020 and 2021:

- Net Profit Margin

- Gross Profit Margin

- Debtor (Receivable) Days

- Creditor (Payable) Days

- Debt Equity Ratio

- Return on Capital Employed

b. Based on the ratios calculated above comment on the financial performance of Glencore over two years.

Question 2

Critically evaluate and explain Shareholder wealth is the most important objective within financial management, also consider what other objectives may be important from a shareholder perspective.

Question 3

Khaled Comms is considering several options for its investment strategy as it expands 5G mobile phone network infrastructure.

You have the following estimations of the revenues and expenditure.

Initial Investment AED 12,000,000

Sales AED 8,000,000 pa

Direct Costs AED 2,800,000pa

Administration AED 900,000pa

Total Costs 3,700,000pa

Khaled Comms has a cost of capital of 10%. Ignore taxation

Khaled Comms believes the machinery will have a six-year life before the next generation upgrade.

a. Calculate the:

Expected payback period

Accounting Rate of Return

Net Present Value

Internal Rate of Return

b. Explain and evaluate which method calculated above is most reliable, which would a firm calculate in practice?

What are the challenges of conducting investment appraisal analysis?

Question 4

Alternatively, Khaled Comms is also considering investment into 5G technology via leasing or buying the phone masts.

The purchase price is AED 22,000 and the machine has a 5 year life. If it buys the machine Khaled Comms will need to fund it using capital that costs them 9% per year.

Alternatively the lease payments will be AED 5,250 per year for 5 years with rentals payable at the start of each year.

a. What are the respective present value costs of purchasing the machine or leasing it?

b. Explain the reasoning for the differences in cost linking to fundamentals of finance theory.

c. Critically evaluate the key differences between funding a project via debt or equity finance, from the perspective of the company directors.

d. At a recent board meeting one director proclaimed the company should fund all projects with internal sources of financing as they are essentially ‘free’ using logical arguments and finance theory explain why this statement is incorrect. Clearly explain the cost of each type of finance relative to the risk.

Are you looking for Financial Management Assignment Solutions? We have MBA assignment experts who assist you with Financial Management Assignment Help at an affordable price. Assignmenthelpaus.com provides 24/7 online assignment writing services for students. Get assistance with 100% plagiarism free content. You can contact us through our live chat facility.

For REF… Use: #getanswers2002351