Get project Answers based Financial Statements, Logical Arguments, Capital Budgeting – associated with management, and public companies for regulatory agency such as the SEC. Get expert help with Financial Management Assignment.

Financial Management Assignment Scenario and Answer for All Questions

Section 1

Answer any NINE (9) out of ELEVEN (11) questions. Question 11 is compulsory.

- Which of the following statements is NOT CORRECT? Justify your choice with logical

| a. | When a corporation’s shares are owned by a few individuals and are not traded on public markets, we say that the firm is “closely, or privately, held.” |

| b. | “Going public” establishes a firm’s true intrinsic value, and it also insures that a highly liquid market will always exist for the firm’s shares. |

| c. | When stock in a closely held corporation is offered to the public for the first time, the transaction is called “going public,” and the market for such stock is called the new issue market. |

| d. | Publicly owned companies have shares owned by investors who are not associated with management, and public companies must register with and report to a regulatory agency such as the SEC. |

| e. | It is possible for a firm to go public and yet not raise any additional new capital at the time. |

- There are several methods of capital budgeting, which one of them is most commonly applied and why? Rationalize your stance.

- Who are the providers (savers) and users (borrowers) of capital? How is capital transferred between savers and borrowers?

- How bankers differentiate between loaning to an individual business and loaning to a corporation? Discuss with reasoning.

- Critically evaluate the following statement:

“Although people’s moral characters are probably developed before they get into a business school, it is still useful for business schools to cover ethics, including giving students an idea about the adverse consequences of unethical behavior to themselves, their firms, and the nation.”

- You are the CEO of a company and you are considering entering into an agreement to have your company buy another company. You think the price might be too high, but you will be the CEO of the combined, much larger, company. You know that when the company gets bigger, your pay and prestige will increase. What is the nature of the agency conflict here and how is it related to ethical considerations?

- Do firms have any responsibilities to society at large? Why or why not?

- You need to analyze a firm’s performance in relation to its peers. You can do this either by comparing the firms’ balance sheets and income statements or by comparing the firms’ ratios. If you only had time to use one means of comparison which method would you use and why? Give logical arguments to support your answer.

- What are some economic conditions that affect the cost of capital?

- Differentiate between internal and external growth rate. Under what circumstances external growth rate could be useful?

- Read the following case and answer the questions listed below:

When hospital staff failed to speak out about poor care, the challenge began to fall on relatives. Julie Bailey began to take on Stafford General Hospital. Believing that it would never happen to her, it happened at Stafford where she took her mom. Julie Bailey’s mother, Bella, had been taken to Stafford General Hospital in September 2007. But, from her first impressions, she believed something was wrong. She recognized that the patients in her mom’s ward couldn’t speak for themselves and the relatives were visiting them oblivious to what was going on. For 8 weeks, Bella’s family members maintained a 24-hour watch at her bedside keeping a record of what they saw. Julie Bailey reads the records made and indicated the fear they had for being branded troublemakers. Bella Bailey died in the hospital in November 2007. Julie Bailey created a determined campaign, in her café, to make people aware of what she had seen but struggled make her voice heard. In an interview, Julie listed all the people she tried to speak to with the intent to try and tell as many people as possible.

At that time she was unaware that the primary investigator of the Health Care Commission was planning to investigate high death rates at the hospital between 2005 and 2008. The report, when made public, showed managers putting targets ahead of patient care. With the mortality rates being further investigated, the report agreed there were serious concerns about patient care. It appeared that some doctors were even, privately, aware of the problems. The Commission report also said that of the majority of doctors interviewed said they would not have been happy for a relative to have been treated there. Julie Bailey expressed her concern that it wasn’t good enough for their relatives but it was good enough for ours. She says if they had known or the doctors had spoken out none of their relatives would have been put there. A Stafford shire MP, Tony Wright—Labour, Cannock Chase, could not believe that doctors would be happy delivering that level of care and that nurses must have been unhappy working in that situation. He had helped introduce legislation to encourage employees to speak up—The Public Interest Disclosure Act of 1998 was intended to give whistleblowers legal protection from dismissal or victimization. Mr. Wright indicates that the whole point of these provisions was so that individuals could raise their concerns properly without threatening their job, without damaging their career, and without having to go to the media. However, in Stafford shire, there was a whole culture that discouraged complaints. The investigation indicated that nurses felt poorly supported as a profession and consultants appeared to have given up expressing their views since managers were said to dislike critical comments and ignored them. Mr. Wright says that the governments should revisit what it said to health organizations in the past—the good things such as the need to get whistle blower protection in place. The new leadership at Mid Staffordshire NHS Foundation Trust has now made it know that quality of care is now its primary concern. To this end, it is investing 12 million pounds in frontline clinical staff, improved training and facilities, and has published a new “no blame whistle blowing policy” aimed to bring poor practice out in the open.

Discussion Questions:

- What corporate governance mechanisms failed at Stafford General Hospital?

- Were there possibilities of agency problems within Stafford? Why or why not? Could managerial opportunism be an issue?

- How do you think the situation at Stafford will impact global corporate governance?

Section 2

Answer any five (4) out of six (6) questions.

Exercise 1

Use the following information of Z Corporation to answer the questions listed below:

| Balance Sheet (Millions of $) | |

| Assets | 2012 |

| Cash and securities | $ 1,554.0 |

| Accounts receivable | 9,660.0 |

| Inventories | 13,440.0 |

| Total current assets | $24,654.0 |

| Net plant and equipment | 17,346.0 |

| Total assets | $42,000.0 |

| Liabilities and Equity | |

| Accounts payable | $ 7,980.0 |

| Notes payable | 5,880.0 |

| Accruals | 4,620.0 |

| Total current liabilities | $18,480.0 |

| Long-term bonds | 10,920.0 |

| Total debt | $29,400.0 |

| Common stock | 3,360.0 |

| Retained earnings | 9,240.0 |

| Total common equity | $12,600.0 |

| Total liabilities and equity | $42,000.0 |

| Income Statement (Millions of $) | 2012 |

| Net sales | $58,800.0 |

| Operating costs except depr’n | $54,978.0 |

| Depreciation | $ 1,029.0 |

| Earnings bef int and taxes (EBIT) | $ 2,793.0 |

| Less interest | 1,050.0 |

| Earnings before taxes (EBT) | $ 1,743.0 |

| Taxes | $ 610.1 |

| Net income | $ 1,133.0 |

| Other data: | |

| Shares outstanding (millions) | 175.00 |

| Common dividends | $ 509.83 |

| Int rate on notes payable & L-T bonds | 6.25% |

| Federal plus state income tax rate | 35% |

| Year-end stock price | $77.69 |

Required:

- What is the firm’s current ratio?

- What is the firm’s quick ratio?

- What is the firm’s day’s sale outstanding? Assume a 360-day year for this

- What is the firm’s total assets turnover?

- What is the firm’s inventory turnover ratio?

- What is the firm’s debt-to-assets ratio?

- What is the firm’s ROA?

- What is the firm’s ROE?

- What is the firm’s profit margin?

- What is the firm’s P/E ratio?

- Based on your above calculation of various ratios, discuss the liquidity position as well as the performance of the firm.

Exercise 2

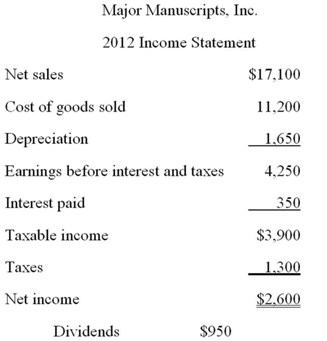

The following information pertains to Major Manuscript Inc. for 2012:

Required:

- Major Manuscripts, Inc. does not want to incur any additional external financing. The dividend payout ratio is constant. What is the firm’s maximum rate of growth?

- How rate of growth can help the firm in financial planning.

Exercise 3

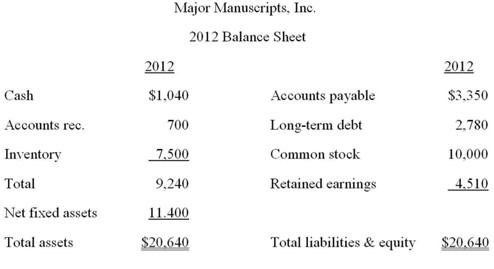

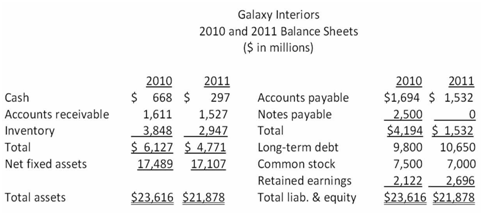

Use the following information to answer the questions that follow:

Required:

- What is the cash flow from assets for 2011?

- Based on your answer in part (a) above, comment on the liquidity position of the

Exercise 4

Beans Corporation current balance sheet shows total common equity of $3,125,000. The company has 125,000 shares of stock outstanding, and they sell at a price of $52.50 per share. By how much do the firm’s market and book values per share differ? How does the difference in these values matter to the firm? Explain.

Exercise 5

Read the following scenario and answer the question given below:

You are on the staff of O’Hara Inc. The CFO believes project acceptance should be based on the NPV, but Andrew O’Hara, the president, insists that no project should be accepted unless its IRR exceeds the project’s risk-adjusted WACC. Now you must make a recommendation on a project that has a cost of $15,000 and two cash flows: $110,000 at the end of Year 1 and -$100,000 at the end of Year 2. The president and the CFO both agree that the appropriate WACC for this project is 10%. At 10%, the NPV is $2,355.37, but you find two IRRs, one at 6.33% and one at 527%, and a MIRR of 11.32%.

Required:

Which of your statements best describes your optimal recommendation, i.e., the analysis and recommendation that is best for the company and least likely to get you in trouble with either the CFO or the president? Use the information given in the case to conveyance the CFO and president.

Exercise 6

Why we evaluate the financial statements? Explain with logical arguments.

Reference ID: #getanswers2001080